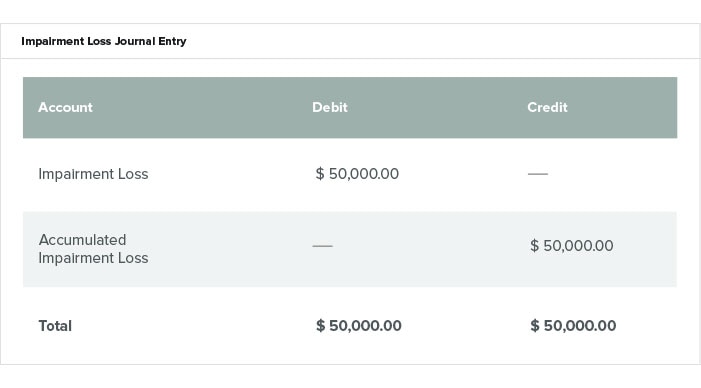

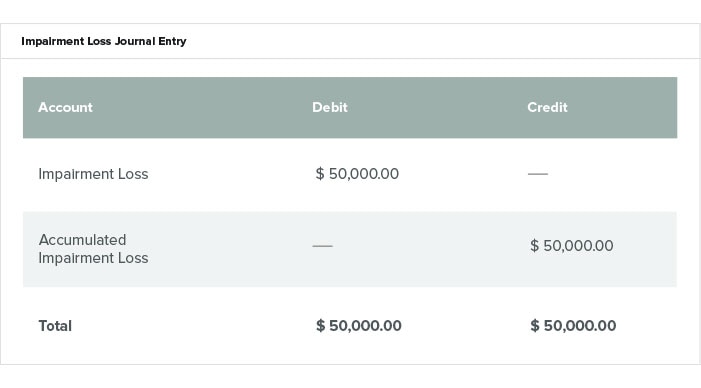

Impairment Loss Journal Entry

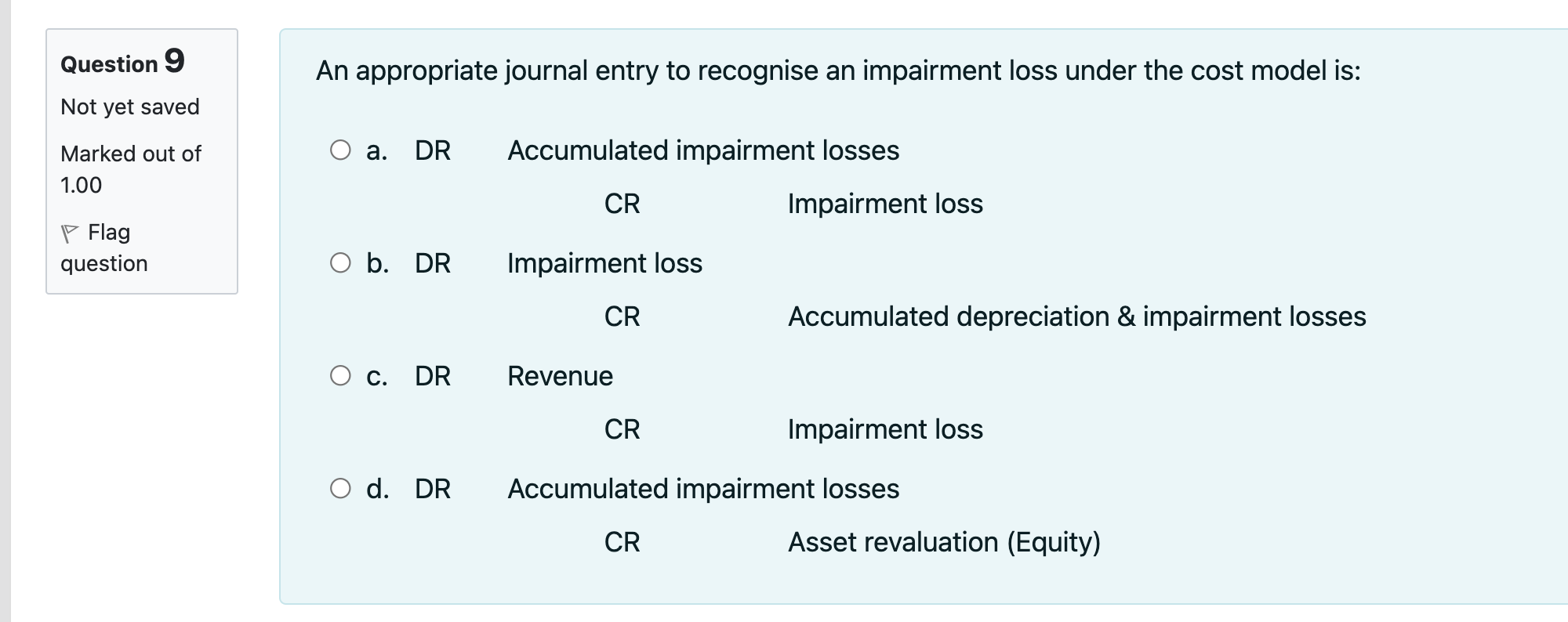

The amount of the. Impairment loss is recognized immediately in PL unless the asset is carried at revalued amount Thus entries would be.

Impairment Loss Accounting Impairment Of Assets Held For Use Vs Intended For Disposal Youtube

There are six criteria provided by the Journal of Accountancy for the impairment loss on land.

. Loss on Impairment Abandonment whatever you want to call it If there is some scrap value to the equipment you should make this journal entry. Impairment should be recorded only when there is a significant decrease in the price or the. The journal entry to record impairment is straightforward.

Recording the Adjusting Entry to INCREASE the Allowance for Impairment loss on trade. On top of that the presentation and disclosures also vary. An impairment loss is recognized through a journal entry that debits Loss on Impairment debits the assets Accumulated Depreciation and credits the Asset to reflect its new lower value.

Journal entry for recording the impairment is the debit to the loss account or to expense account with the corresponding credit to an underlying asset. Scrap inventory not a fixed asset. This asset was.

Dr Impairment losses ac PL account Cr Asset. It is also known as the. The company can make the fixed asset impairment journal entry by debiting the impairment losses account and crediting the accumulated impairment.

The journal entry above shows the write-off of an asset from the Balance Sheet. However the actual accounts used for them differ. Fixed asset impairment journal entry.

You must record your impairment loss by creating a new journal entry. The decrease in the fair value in this case is 20000 160000 140000 and as the balance of revaluation surplus is only 18000 in above example the excess amount of 2000 20000. Therefore the journal entries for impairment loss are similar to depreciation.

Record the loss by increasing your Expense account. Recording an impairment loss for an individual asset - examples Revaluation model An asset has a CA of 100 FV of 120 accum depn of 20 and a RA of 90. Accounting Treatment for Impairment.

Impairment loss is the deduction of assets value when the market value falls below the carrying amount on balance sheet. Creation of the Allowance for Impairment loss on trade receivable account. Journal Entry for Impairment Loss.

Following an impairment loss subsequent depreciation charge is adjusted to reflect lower carrying amount IAS 3663. In this journal entry the goodwill which is an intangible asset on the balance sheet of the company ABC will be reduced by 1000000 as a result of the impairment. However before recording the impairment loss a company must first.

This is an impairment loss. Impairment majorly constitutes a reduction in the value of an. Journal Entry For Fixed Assets Impairment.

Journal entry to record impairment loss. The impairment loss should be recognised in the profit or loss immediately unless the revaluation decrease treatment is prescribed in another accounting standard. You can do this through a debit.

And you need to. Impairment loss Dr Accumulated impairment loss Cr In case there is revaluation surplus journal entry will be as follows.

Solved Question 9 An Appropriate Journal Entry To Recognise Chegg Com

Fixed Asset Accounting Made Simple Netsuite

Accounting For Property Plant And Equipment Reversal Of Impairment Loss Part 1 Youtube

Accounting Treatment For Impairment Of Financial Assets Under Ifrs 9 Download Scientific Diagram

No comments for "Impairment Loss Journal Entry"

Post a Comment